David Neiheisel | NMLS: 1532518

Mortgage Advisor | Loan Originator

513.518.0155

Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

David Neiheisel | NMLS: 1532518

Mortgage Advisor | Loan Originator

513.518.0155

Today’s higher mortgage rates, inflationary pressures, and concerns about a potential recession have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to think about the long-term benefits of homeownership when making your decision.

Consider this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how home values grow with time and how, by extension, that grows your own wealth. That may be why, in a recent Fannie Mae survey, 70% of respondents say they believe buying a home is a safe investment.

Here’s a look at how just the home price appreciation piece can really add up over the years.

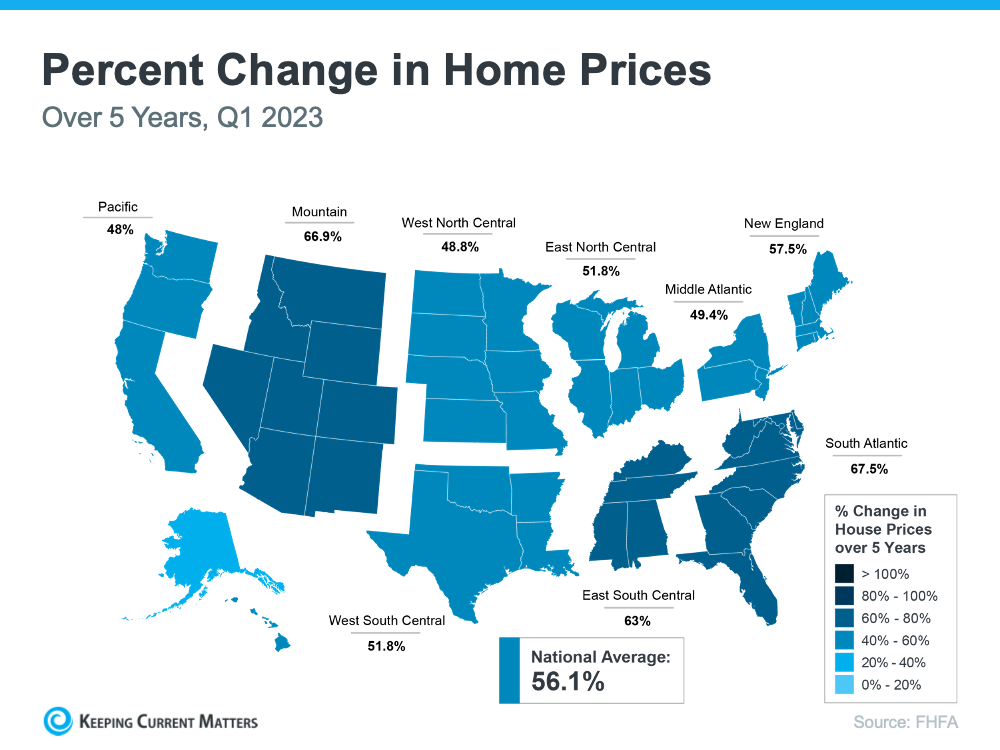

The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy price gains have been over the last five years. And, since home prices vary by area, the map is broken out regionally to help convey larger market trends.

If you look at the percent change in home prices, you can see home prices grew on average by just over 56% nationwide over a five-year period.

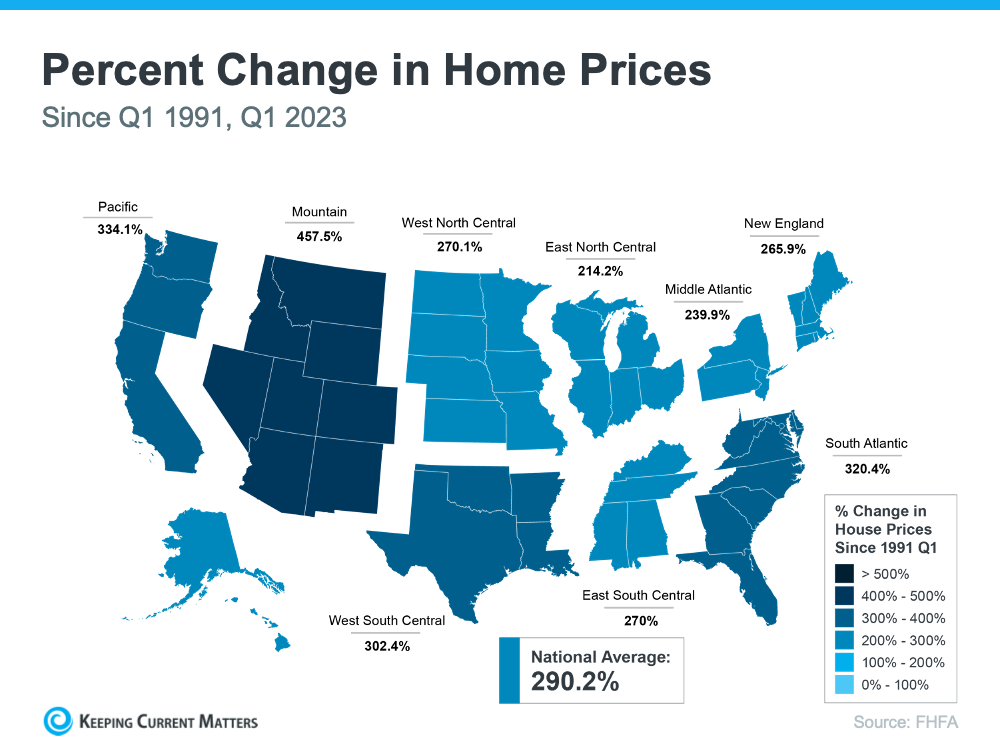

Some regions are slightly above or below that average, but overall, home prices gained solid ground in a short time.And if you expand that time frame even more, the benefit of homeownership and the drastic gains homeowners made over the years become even clearer (see map below):

The second map shows, nationwide, home prices appreciated by an average of over 290% over a roughly 30-year span.

This nationwide average tells you the typical homeowner who bought a house 30 years ago saw their home almost triple in value over that time. That’s a key factor in why so many homeowners who bought their homes years ago are still happy with their decision.

And while you may have heard talk in late 2022 that home prices would crash, it didn’t happen. Even though home prices have moderated from the record peak we saw during the ‘unicorn’ years, prices are already rebounding in many areas today. That means, in most markets, your home should grow in value over the next year.

The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and deal with annual lease hikes for no long-term financial benefit? Instead, consider buying a home.

If you’re questioning if it still makes sense to buy a home today, remember the incredible long-term benefits of homeownership. If you’re ready to start the conversation, reach out to a real estate professional today.

|

|||||||||||

|

|||||||||||

|

Real Estate Updates | Area Reports | May 2023

|

|||||||||||

|

|||||||||||

|

|

|||||||||||

|

|||||||||||

|

Real Estate Updates | Area Reports | March 2023

|

|||||||||||

|

|||||||||||

|

Here are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each one.

This is the factor most people are focused on when they talk about homebuying conditions today. So far, current rates are almost four full percentage points higher than they were at the beginning of the year. As Len Kiefer, Deputy Chief Economist at Freddie Mac, explains:

“U.S. 30-year fixed mortgage rates have increased 3.83 percentage points since the end of last year. That’s the biggest year-to-date increase in rates in over 50 years.”

That increase in mortgage rates is impacting how much it costs to finance a home purchase, creating a challenge for many buyers that’s pricing some out of the market. While the current global uncertainty makes it difficult to project where mortgage rates will go in the future, experts do say that rates will likely remain high as long as inflation does.

The second factor at play is home prices. Home prices have made headlines over the past few years because they skyrocketed during the pandemic. Now, the most recent Home Price Index from S&P Case-Shiller shows home values continued to decelerate for a fifth consecutive month (shown in green in the graph below):

This deceleration is happening because higher mortgage rates are moderating demand, and as a result, easing the buyer competition and bidding wars that previously drove prices up.

What’s worth noting though, is how much higher home prices still are than they were before the pandemic (shown in blue in the graph above). Even now, we have a long way to go to get to more normal levels of home price appreciation, which is historically closer to 4%. When both mortgage rates and home prices are high, affordability and your purchasing power become a greater challenge.

But while prices are still elevated in many markets, some areas are seeing slight declines. It all depends on your local market. For insight into what’s happening in your area, reach out to a trusted real estate professional.

3. Wages

The one big, positive component in the affordability equation is the increase in American wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have grown over time. This year is no exception.

As the Bureau of Labor Statistics (BLS) reports:

“Median weekly earnings of the nation’s 120.2 million full-time wage and salary workers were $1,070 in the third quarter of 2022 (not seasonally adjusted), the U.S. Bureau of Labor Statistics reported…This was 6.9 percent higher than a year earlier…”

So, when you think about affordability, remember the full picture includes more than just mortgage rates. Home prices and wages need to be factored in as well. Because wages have been rising, they’re a big reason why serious buyers are still purchasing homes this year.

If you have questions or want to learn more, reach out to a trusted advisor who can explain how all of these variables work together and what’s happening in your area. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Buying or selling a home involves a series of requirements and variables, and it’s important to have someone in your corner from start to finish to make the process as smooth as possible… and objectivity to deliver trusted expertise to consumers in every U.S. ZIP code.”

To learn more, reach out to a trusted real estate professional and a local lender so you’re able to make an informed decision if you’re planning to buy or sell a home right now.

Source: Keeping Current Matters

/ BY KCM CREW

Coldwell Banker - Ohio Indiana West Regional

© 2025 Coldwell Banker Real Estate LLC

© Coldwell Banker 2023 – 2025. All Rights Reserved. Coldwell Banker and the Coldwell Banker logo are trademarks of Coldwell Banker Real Estate LLC. The Coldwell Banker® System is comprised of company owned offices which are owned by a subsidiary of Anywhere Advisors LLC and franchised offices which are independently owned and operated. The Coldwell Banker System fully supports the principles of the Fair Housing Act and the Equal Opportunity Act.