ELIGIBLE WITH CONVENTIONAL, FHA & VA Loans @ best market rates available

1. Get pre-approved

2. Negotiate a contract now with delayed closing end of March 2025

3. Name goes onto our reservation “waiting” list (contract, paystubs and signed application needed)

4. Grant is reserved once start date (March 3)

5. Buyer gets $20,000 grant credit at closing

Who are Eligible Homebuyers? A homebuyer would be eligible for the Welcome Home grant if

all of the following guidelines are met:

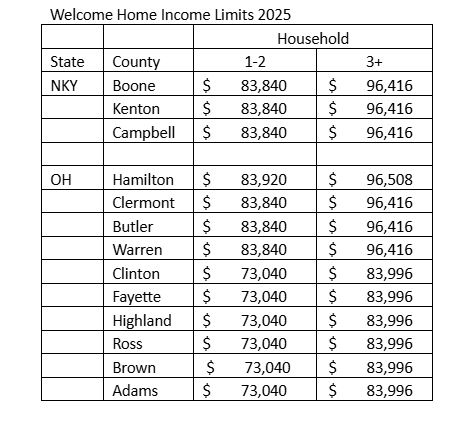

- The total income for all occupants who will reside in the home is at or below 80 percent of the Mortgage Revenue Bond (MRB) limit for the county and state where the property is located (see income limits below);

- A fully executed (signed by buyer and seller) purchase contract on an eligible property is in hand;

- The homebuyer has at least $500 of their own funds to contribute towards down payment and/or

closing costs; and, - If a first-time homebuyer (typically anyone who has not owned a home in the last three years), a

satisfactory homebuyer counseling course is completed prior to the loan closing. Note: Applicants do not

have to be first-time homebuyers.

Not all banks are participating, contact me for a list of local lenders with this program. This program is a limited time, and first serve first come bases.

*Must be under Household income limits:

**Call for other County limits

![]()

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link